On July 4, 2025, Americans celebrated not only our nation’s independence, but also the restoration of our constitutional Second Amendment rights becoming unconstrained by burdensome and arbitrary fees. That day, President Donald Trump (R) signed into law the largest tax-relief legislation in American history. Included in the legislation was a historic win for liberty and for lawful gun owners across the country. For the first time in nearly a century, we struck down one of the most unfair and outdated taxes ever imposed on law-abiding Americans; in fact, this victory marks the first time a federal firearm tax has been eliminated since 1928.

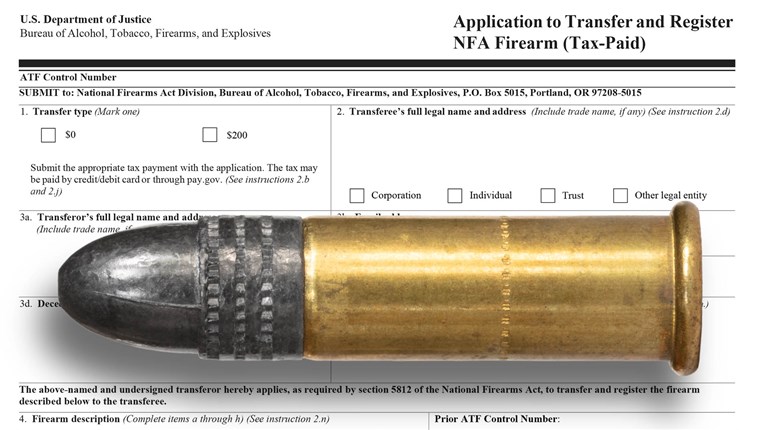

Starting Jan. 1, 2026, the $200 federal tax stamp and the $200 manufacturer or “making” tax on short-barrel shotguns, short-barrel rifles and firearm suppressors will be eliminated. That means Americans who choose to exercise their Second Amendment rights will no longer face a government-imposed financial penalty. I wrote this provision into the bill because the Second Amendment is not for sale, and it should never carry a price tag.

To understand the importance of this change, one needs to understand its history. In 1934, Congress slapped a $200 tax on short-barrel shotguns, short-barrel rifles and suppressors. The purpose was simple. Washington sought to discourage ordinary Americans from exercising their constitutional right to defend themselves. It worked. For decades, only the wealthy or the most determined could afford to pay the tax or navigate the long and complicated process for these arbitrarily short firearms or suppressors designed to protect their hearing.

The rights guaranteed by the U.S. Constitution belong to every American regardless of income or tax bracket. Our constitutional rights should never be privileges for the wealthy. They are freedoms that must be protected from government overreach. These rights are secured by our right to keep and bear arms.

From the very beginning, this tax was never about public safety; it was about government control. Short-barrel shotguns, short-barrel rifles and especially suppressors have long been misrepresented in movies and in the media. In reality, suppressors are a common-sense safety tool that protects hunters and sportsmen from permanent hearing damage; in fact, tinnitus, a condition often associated with hearing loss, is the most common service-connected disability among American veterans. In many European countries, suppressors are viewed as basic courtesy equipment, not sinister additions to guns. Yet for 91 years, Americans were forced to pay a penalty to use them.

The tax was unfair on its face. No constitutional right should require a government fee. Imagine if you had to pay $200 to attend church, to publish a newspaper article, or to post on social media. Americans would never tolerate a tax on the First Amendment. Neither should they be forced to tolerate a tax on the Second Amendment. By eliminating the tax stamp, we are correcting a nearly century-old wrong that never should have existed.

The Republican tax reforms are delivering much-needed relief for working families, but for defenders of liberty, one provision stands out above all others. Ending the taxation on suppressors and short-barrel rifles and shotguns is the greatest legislative victory for the Second Amendment in a century. I am proud to have worked on this legislation to roll back unnecessary and burdensome regulations on law-abiding gun owners. The repeal of the federal tax on firearms and suppressors shows that when Americans demand change, Washington must heed the call.

On Independence Day 2025, we honored the spirit of our Founders by cutting taxes, securing our borders, reining in spending and protecting our constitutional rights. On Jan. 1, 2026, that spirit becomes reality when the suppressor tax disappears for good. The Second Amendment is stronger today than it was yesterday. That is worth celebrating.

Jason Smith represents Missouri’s 8th Congressional District and is chairman of the House Committee on Ways and Means.